As a teacher or counselor, you play a critical role in helping students choose their postsecondary path. Part of this process involves talking to students about exploring their interests and preparing for college. However, one of the most important factors for students and families when deciding whether to go to college is affordability. You should not shy away from the subject; your students will thank you for it.

‘Can I Afford Going to College?’

This is the question many students ask themselves, especially if affordability is perceived as a barrier to enrolling in college. Families essentially want to know which colleges they can afford and what will be the real cost compared to the sticker price. First, you should review with students what cost of attendance refers to, as there are decisions they can make to bring down their cost of attendance at a particular institution.

Students pay more than tuition when attending college; they must cover for books, supplies, room and board (housing and bills), transportation, and other personal expenses. It is important for students to understand what their estimated cost of attendance could be so they can plan for covering it. Students risk not completing their education when they don't realize the potential cost of attendance of their program of choice.

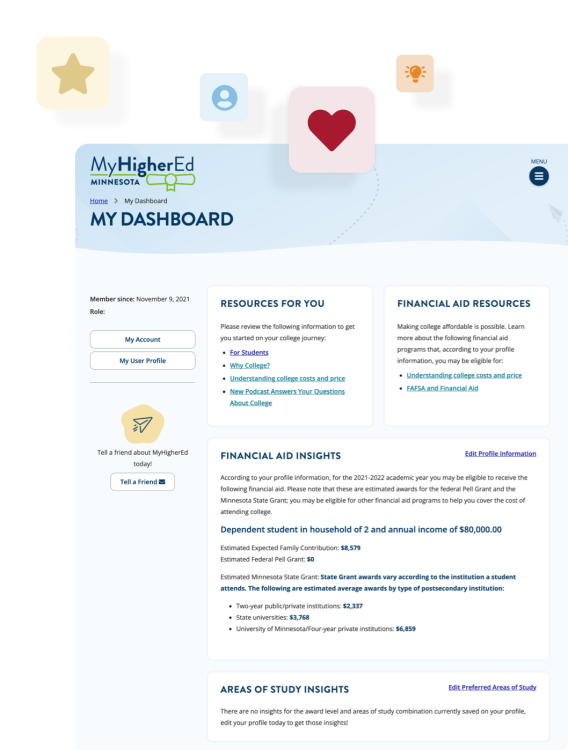

Additionally, your students should be aware of the many resources available to help them reduce the total cost of education or training, many of which don’t need to be paid back, such as grants and scholarships. This will help them determine if they -and their families- have adequate resources to pay for college expenses. You can help students look for or calculate their pocket cost or net price at a particular school. Net price is the amount they must pay for their program after grants and scholarships are applied. Colleges may provide net price calculators on their websites for prospective students. Your students may also use our College Search Tool to compare Minnesota institutions, including their net price according to family annual income.

Finally, there are practical steps students can take to cut back on college costs while they’re still in high school. Below are some ideas you can suggest that will make college more affordable for your students.

Tips To Offer to Your Students

Apply for financial Aid

Applying for financial aid can be a complicated process for students and families, but given the exponentially increasing cost of college, it is often needed to make college possible for many. Your expertise and advice in this area -or directing students to financial aid experts- can mean the difference between a student going off to college with a robust financial aid package or not applying to college at all.

Since financial aid package often include grants, scholarships, and work study awards, in addition to student loan options, it’s advisable to encourage students to fill out the Free Application for Federal Student AID (FAFSA) as soon as they’ve applied to their potential schools.

This funding is made available through the federal and state government and many colleges and universities also offer their own assistance to students through institutional grants and scholarships. These are often based on past academic performance, or financial need, but are also distributed on a first-come first-serve basis, so it’s important for students to apply early.

Scholarship Options

As you know, scholarships are one of two forms of financial aid that do not need to be repaid. They are awarded based on a student's academic or athletic achievement, cultural or religious background, or special skills and talents. A new Minnesota program that could benefit your students is the North Star Promise Scholarship, which offers tuition-free college for eligible Minnesota residents at eligible institutions.

Scholarships may be awarded through an institution or as part of the financial aid package without additional paperwork, or they may require your student also need to search and apply for specific scholarships.

You may want to suggest that students keep an eye out for private scholarships given by community organizations, foundations, corporations, clubs, civic, and cultural groups.

Scholarships can also be found online using one of the free scholarship search sites listed below:

- CollegeNet • www.collegenet.com

- FastWeb • www.fastweb.com

- Minnesota Institutional Scholarships • www.ohe.state.mn.us/mnscholarships

- Scholarships.com • www.scholarships.com

However, advise that students to review these scholarship tips, and to be wary of any scholarship search companies charging fees, guarantying scholarships, and asking for credit card or checking account information to receive a scholarship.

Earn credits while in high school

One of the most effective ways to lower postsecondary school costs is for students to earn college credits is while in high school. If any or all of these programs are available within your school, consider reviewing the student’s academic standing and advise him or her on the benefits of participation.

- Advanced Placement (AP)

- Concurrent Enrollment (CE)

- International Baccalaureate (IB)

- Postsecondary Enrollment Options (PSEO)

- Project Lead the Way (PLTW)

- College-Level Examination Program (CLEP)

Graduate as soon as possible

Many students decide to study part-time, or have to scale back their credit load due to personal or work-related reasons. As understandable their approach may be, you should remind your students that any extension to their college studies will come with expenses, even if they do not have to pay for more academic credits. For example, adding an additional year to a bachelor’s degree schedule has the potential to add an extra $4,000 in student loans. Moreover, there’s the possibility they may run out of money to finish their degree.

Advise your students to plan ahead their college journey so they will be on track to complete their program in the shortest time possible.

Go To An In-State School Or Utilize Tuition Reciprocity Agreements

The terms in-state or out-of-state tuition apply only to public colleges and universities.

If a student is considering a public university, you could suggest that he or she attend an in-state institution. Given that in-state public school tuition is typically much less expensive than out-of-state tuition, this offers one way to make college more affordable.

Another affordable option is for students to utilize the state’s regional tuition exchange program. Minnesota has statewide tuition reciprocity agreements that allows students to attend institutions in Wisconsin, North Dakota, South Dakota, and Manitoba at reduced tuition rates.

Please advise students who are interested in attending a qualifying out-of-state school to apply for the tuition reciprocity benefits as soon as they know they know they’ll be attending an eligible institution. Applying early ensures he or she will be charged the reciprocity tuition rate when they register for classes.

Attend Community College, Then Transfer

For some students, a community college program, certificate or associate’s degree is exactly what they need in order to take the next step in their career.

For others, attending community college before transferring to a four-year university is a great option to keep costs more affordable as they figure out their career path while completing their general education requirements.

Aside from typically having lower tuition costs, students who choose to attend college near their hometown save a lot of money by living at home and commuting.

Community Service Or Military Benefits

Students pay for part of their college education by serving their community or country before or after they attend college. Some find that these opportunities offer valuable experiences through diverse programs that reward work and service with financial aid for college.

- AmeriCorps

AmeriCorps is a cooperative effort between the federal government, the state, and local agencies to improve community service around the country. Jobs often are available in projects addressing preschool education, dropout prevention, literacy, low-income housing, assisted living for the elderly and people with disabilities, violence prevention, conservation, and neighborhood recycling. Students may be eligible to receive a stipend and an education award through the program to help pay for their education. - Military Service

Those called to active duty while enrolled in college receive certain protections regarding financial aid eligibility, enrollment status, and loan repayment. In most instances, the student will not be penalized as a result of his or her absence to perform active military service. In addition, there are federal and state educational benefits for students who have served or are serving in the armed forces.

Professions That Offer Loan Forgiveness

As you work with students to help them explore career paths, it’s good to be aware some of the loan forgiveness options that may be available to them. Examples include:

- Teacher Shortage Loan Repayment Program

- Minnesota Agricultural Education Loan Repayment Program

- Minnesota Aviation Degree Loan Repayment Program

- Minnesota Rural Veterinarian Loan Repayment Program

College Search Tool

Search and compare Minnesota colleges and institutions by cost, size and program.

Ready, Set, FAFSA!

A series of webinars to help your students access financial aid.