Whether you start your college program with the desire to expand your horizons, get the job of your dreams, or meet like-minded people, finishing is important. Planning your college journey will help you get the most out of your college experience.

No matter the type of credential you are pursuing (may it be a certificate, associate, or bachelor's degree), planning will help you achieve your goals and do it as affordably as possible. Remember, any extension to completing your degree will come with expenses, even if you may not have to pay for more academic credits.

Does It Pay To Graduate More Quickly?

The path to completing college looks different for everyone, and understandably so. Your program of study, your financial situation, and/or personal responsibilities can affect your timeline for completing your program. By taking 30 credits a year, or even by adding one more class to your credit load, you will be on track to complete your program in the shortest time possible. The clear advantages are:

- Earlier entry into your career and job market

- Earning a full-time income sooner!

Earning your certificate, associate's, or bachelor’s degree offers you the financial incentive of higher income. In Minnesota, high school graduates increase their earning potential by 20% with a certificate or associate degree, and by 67% with a bachelor's degree. Moreover, the benefits keep accumulating after completing your degree. Four years after graduation, your salary will increase an average of 23% (certificate), 25% (associate degree), 23% (bachelor's degree), and 13% (graduate certificate and degree).

Source: Minnesota Department of Employment and Economic Development (2016 data)

You can finish your degree and get to that paycheck faster by effectively planning your course schedule and thinking ahead. Some classes may be only offered once a year and upper-level classes often have prerequisites. If you’re strategic and smart with your planning, getting the required number of credits to graduate should not be a barrier.

Affordability

On the flip side, it’s also important to remember that any extension to your college career will come with expenses, even if you may not have to pay for more academic credits. Student loans can accrue interest, and there are supplies and books to take account for. Adding an additional year to a bachelor’s degree schedule has the potential to add an extra $4,000 in student loans. Moreover, there’s the possibility you may run out of money to finish your degree.

Likewise, financial aid packages awarded by the institutions are usually for four years, in the case of a bachelor's degree program. This means your fifth year will probably not include the same financial aid, if any.

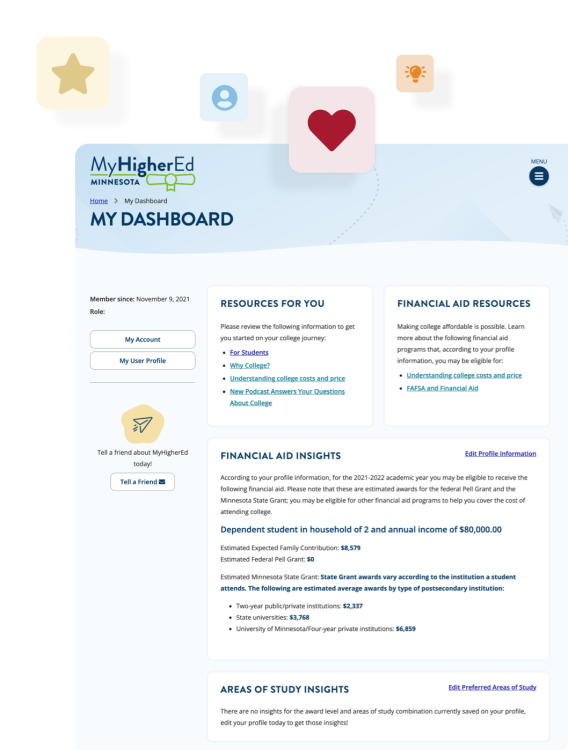

In the case of federal aid, the amount of Pell Grant funds you may receive over your lifetime is limited to be the equivalent of six years (or 180 credits) and includes all of the colleges you attended. Similarly, the Minnesota State Grant has expanded the maximum amount of funds to cover 180 credits in a lifetime. With this in mind, it’s important that you take the appropriate classes and make sure your credits count toward your desired degree, so you’re not surprised by the price tag later on and don't run out of funds.

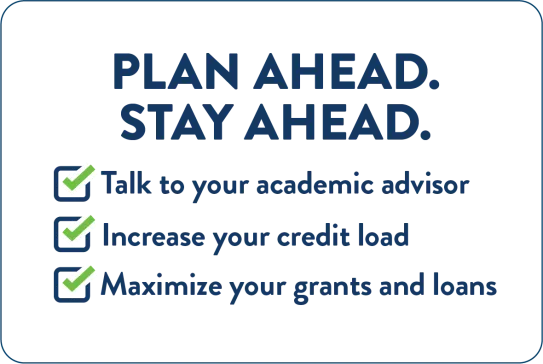

Tips to Help You Earn Your Degree in the Shortest Time Possible

For Certificate and Associate Degree Seekers

- Take advantage of your academic advisor. Schedule a time to chat once a semester to ensure you’re still on track. They can help plan out your credit load taking under consideration things like curricula requirements, class availability, scheduling, and work opportunities ahead.

- Inquire about tuition assistance and work credits. Employers want to invest in their talent pool. If you are a working student, don’t be afraid to explore your options regarding schedule accommodations or monetary support from your employer. Your academic advisor may also be able to assist with translating work credits to school credits.

- Take one more class per semester. Don’t overexert yourself, but if you find your planned schedule is a lighter load than expected, consider taking one more class per semester. For part-time students, your academic advisor may be able to help navigate the best path for you in terms of course load.

- Consider summer classes. We get it: the prospect of attending college when you don’t have to may not be on your list, but it can actually be a very helpful way to lighten your class-load during the regular academic year. If you already know a particular class is going to be tough, having one less class on your docket can be a big help, especially if you plan to get a part-time job or internship in addition to school.

- Have a contingency plan. You can’t prepare for absolutely everything. Unforeseen circumstances have the potential to extend your college timeline. Knowing your tuition and other college fees and factoring that into a savings plan can help avoid being thrown off track with unexpected costs. Make sure to apply for any financial assistance proactively to assure long term goals are attainable.

- Learn to work in different environments. Your 20-minute bus ride to campus might become primetime to catch up on homework or projects. Whatever your situation, figure out how and where you can effectively study.

- Consider evening and online classes. To reiterate, your college wants to help every student succeed, no matter their situation. Many institutions offer night classes, online courses or may even post their lectures as podcasts. These are great options if an emergency arises and you need to stay home to attend to a partner or child instead of physically going to campus.

- Utilize campus education resources. Take advantage of onsite writing centers and tutoring services, if you need them. Don’t be afraid to ask for help.

For Bachelor's Degree Seekers

- Design your path to graduation. Schedule a time to chat once a semester with your academic advisor to ensure you’re still on track. You can’t plan for everything, but having a plan in place can help in a time of crisis.

- Avoid excess credits. Only take courses that count towards your major.

- Take 30 credits each year or one more class per semester. Don’t overexert yourself, but if you find your planned schedule is a lighter load than expected, consider taking one more class per semester or adding a summer or J-term class. For part-time students, your academic advisor may be able to help navigate the best path for you.

- Consider summer classes. These can help you meet your goal of 30 credits per year or as close as possible. Also, If you already know a particular class is going to be tough, having one less class on your docket can be a big help, especially if you plan to get a part-time job or internship in addition to school.

- Maximize your state and federal grants and loans. Make sure you are enrolling in enough credits to get the full funding available to you in your financial aid package. Also, some scholarships and grants are dependent on maintaining a certain GPA. Don’t become complacent and lose your financial support! Take advantage of campus writing centers and tutoring services if you need it. Don’t be afraid to ask for help. In addition, you may be able to take general education requirements elsewhere for a lower investment, while maintaining upper level credits at your preferred school.

- Keep up the pace. Stick to your academic plan to graduate on time. Don’t drop classes mid-semester without adding a summer plan to make up missed credits.

- Save time with on campus accommodations. For commuters or working students, many schools have campus day care, health office, bank, post office, copy center, quiet study rooms, access to a kitchen and technical help for personal devices and laptops. Staying on campus between classes can allow for more uninterrupted work time.

- Learn to work in different environments. Sometimes, the library is full. The sooner you can learn to adapt and be successful in other environments as well, the better.

Maximum allowable borrowing amounts in unsubsidized

federal loans for dependent undergraduate students.

Source: studentaid.gov