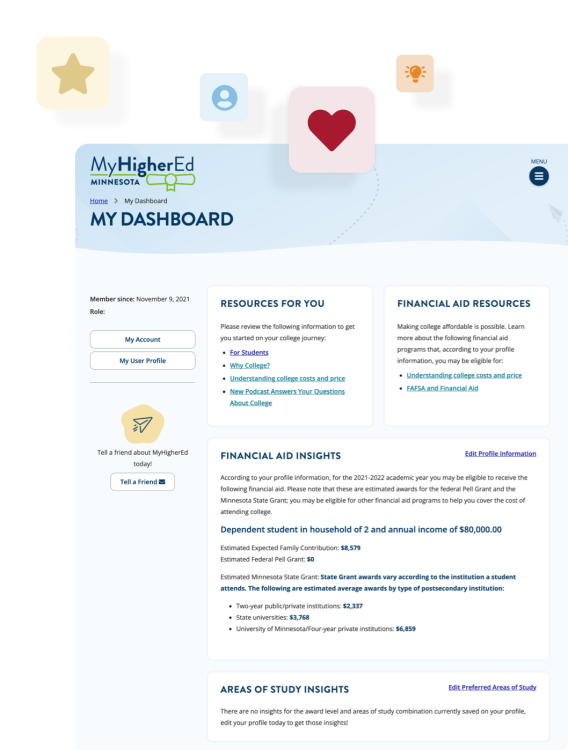

If you think you can’t afford to go to college, think again! Financial aid has helped millions of students pay for their education beyond high school. In fact, just last year, and estimated 13 million students received $150 billion in aid. This aid comes in many forms, from scholarships and grants to loans and work study programs.

Student financial aid is made available through the federal and state government. Additionally, many colleges and universities offer their own assistance to students through institutional grants and scholarships. These are often based on past academic performance, or financial need.

To determine your eligibility for financial assistance, begin by filling out the Free Application for Federal Student Aid (FAFSA). After applying to one or more colleges, it’s the starting point for receiving financial aid no matter where you ultimately decide to enroll.

The Free Application for Federal Student Aid (FAFSA)

The FAFSA may seem intimidating, but over the years the application process has become more streamlined. On average it takes approximately 30 minutes to complete online if you have the necessary information and paperwork on hand.

Have the following financial records to ensure the process goes as quickly and smoothly as possible:

- Your Social Security Number

- Your Alien Registration Number (A-Number) if you’re not a U.S. citizen

- Federal income tax returns (you will be asked to provide consent and approval to disclose your federal tax information to be eligible for federal student aid.)

- Records of child support received

- Your current balance of cash, savings, and checking accounts

- Bank statements and records of investments (if applicable)

- Records of net worth of investments, businesses, and farms

- Records of untaxed income (if applicable)

- A StudentAid.gov account username and password to log in to StudentAid.gov and start the FAFSA form electronically

If you're a dependent student, then your parent(s) will need most of the above information. If you’re a married student who did not file a joint tax return with your spouse, then your spouse will need most of the above information.

Your FAFSA will be reviewed, and an electronic summary will be sent to the colleges you mark on your FAFSA. This summary will confirm the information you provided on the FAFSA and will contain your Student Aid Index (SAI). SAI is an eligibility index number that your college’s financial aid office will use to determine how much federal student aid you would receive if you attended their institution.

NOTE: Applying for financial aid does not cost anything. By applying, you do not commit yourself to attend any college.

The College Planning Series

If you and your family have questions about the FAFSA, share with them these college planning webinars created specifically for students and families to help them prepare for the college-going process. All sessions are approximately one hour long with a short presentation from financial aid experts, followed by questions from the audience.

Register for these upcoming sessions in 2026:

- January 20: Earn College Credit in High School | 7:00 pm - 8:00 pm

Learn more about the different ways to earn college credit while still in high school. - February 3: Scholarships 101 | 7:00 pm - 8:00 pm

Learn how to search and apply for scholarships to help you pay for your education after high school. - February 10: FAFSA 101 | 7:00 pm - 8:00 pm

Join us to learn more about the FASA, including specific sections of your application, tips to avoid common errors and more. - February 17: Understand Your Financial Aid Offer | 7:00 pm - 8:00 pm

Learn more about how to read and understand a financial aid offer letter from a college. - February 24: Understanding Your Transfer Credit | 7:00 pm - 8:00 pm

There is more than one pathway to complete your degree. Join us to learn more about how to transfer credit between colleges.

Visit the Minnesota Goes to College website to learn more about this series.

The 2026-2027 FAFSA

The new form for academic year 2026-2027 is now available.

When do I apply for financial aid?

Deadlines vary among financial aid programs. The earliest you can submit the FAFSA to apply for state and federal need-based aid is October 1 for the following academic year. You must reapply for financial aid each year.

Application Deadlines:

- Minnesota State Grant: The end of the academic year (June 30).

- Federal Pell Grant: The end of the academic year (June 30).

- Institutional Scholarships: Deadlines vary, check with your school (many colleges have March 1 or April 1 deadlines).

- Other Scholarships and Grants: Deadlines vary, check with the scholarship.

Eligibility for Financial Aid

Dependent or Independent Status

All students are considered either dependent or independent when applying for financial aid. Dependent students must submit financial information about their parents on the FAFSA. This information is required even if the parents do not intend to help pay for the student’s education.

You are automatically considered an Independent Student for the 2021-22 school year if you are 24 or older as of December 31, 2020. If you are under 24, you will be considered an independent student if you are any one of the following:

- A graduate or professional student;

- Married;

- A student with children or other dependents;

- On active duty military service;

- A veteran of the U.S. Armed Forces;

- An orphan or ward of the court;

- In foster care at any time, age 13 or older;

- In legal guardianship or emancipated minor status as of the data of application (or 18th birthday if a Minnesota resident); or

- Determined to be an unaccompanied homeless youth.

Appeals: If you think you should be considered independent because of unusual circumstances, talk to the financial aid administrator at your college about a “dependency override.” The aid administrator may use their professional judgment to change your status to independent based on your family situation.

Citizenship Requirements

To complete the FAFSA, you must be a citizen or eligible non-citizen. However, undocumented students in Minnesota may qualify for state financial aid under the Minnesota Prosperity Act commonly known as the Minnesota Dream Act.

Class Load

Increases and decreases in your number of credits per term may affect how much financial aid you are eligible to receive. Check with your financial aid office for more details.

School Transfers

Financial aid does not automatically transfer with students to a new college. You’ll need to contact the financial aid office at the new college to determine what actions should be taken to receive aid. Students must be sure to have an electronic version of the FAFSA sent to the new institution.

In closing, the FAFSA can be complicated. If you have additional questions about the application or process reach out to the financial aid office at your prospective college, a high school career counselor or keep an eye out for possible financial aid informational sessions at your school.

Minnesota Dream Act

While undocumented students are not eligible to complete the Free Application for Federal Student Aid (FAFSA), other financial support and resources may be available.

The Minnesota Dream Act is the state's financial aid application for students with undocumented status. College-bound students who plan to attend college or career school during the 2026-27 school year should complete the 2026-27 MN Dream Act Application. Like the Free Application for Federal Student Aid (FAFSA), the application must be completed each academic year that the student is enrolled in college.

To be eligible for the MN Dream Act, undocumented students must meet the following criteria:

- Attended a Minnesota high school for at least 3 years; and

- Graduated from a Minnesota high school or earned a GED in Minnesota; and

- Registered with the U.S. Selective Service (applies only to males 18 to 25 years old); and

- Provide documentation to show they have applied for lawful immigration status but only if a federal process exists for a student to do so (does not include applying for Deferred Action for Childhood Arrivals). There is currently not a federal process in place, so this documentation is not currently required.

Students who complete the MN Dream Act are eligible for state-based financial aid, including the Minnesota State Grant and North Star Promise Scholarship, if they meet state residency requirements. Students can also receive in-state resident tuition rates and privately funded financial aid at Minnesota public colleges and universities.

Deferred Action for Childhood Arrivals (DACA) Eligibility

Minnesota students granted Deferred Action for Childhood Arrivals (DACA) may also be eligible for these benefits. DACA students will qualify for benefits if they meet the criteria for the MN Dream Act.

NOTE: DACA students who don't meet the MN Dream Act criteria may still be eligible for state financial aid if they can meet at least one of the criteria in the state residency law used for financial aid after they have been granted DACA.

Eligible DACA students with work authorization and Social Security numbers can be considered for State Work Study funding, which allows the student to earn money working on campus. Eligible MN Dream Act students can also apply for a Postsecondary Child Care Grant, which is a need-based grant to students with children in child care while they attend school.

Frequently asked questions

How do MN Dream Act and/or qualifying DACA students apply for benefits?

Undocumented students can apply for state financial aid by accessing the online MN Dream Act - State Financial Aid application. To be eligible for the MN State Grant, the application must be submitted no later than the 30th day of the term. The results of the application can also be used to qualify for in-state tuition rates at the University of Minnesota Twin Cities and Duluth campuses. Students attending Minnesota State campuses should also use this application to apply for state financial aid, but should apply for in-state tuition rates directly with the Minnesota State campus.

The MN Dream Act application should be submitted once for each academic year the student is enrolled in college.

What documentation will be needed?

After the student submits the MN Dream Act application, the student will receive an email letting the student know the following information will need to be submitted to the Minnesota Office of Higher Education to prove the student meets the requirements in the law. This information will only need to be provided the FIRST year the student applies.

- MN high school transcripts showing attendance at a MN high school for at least 3 years (do NOT have to be certified copies)

- MN high school diploma (or transcript showing the student graduated) or copy of GED earned in MN (does NOT have to be certified copy)

- Copy of Selective Service card showing the student registered with the U.S. Selective Service (applies only to males 18 to 25 years old). If the student has not yet registered with Selective Service, the student should do so now. If the student has a Social Security number, the student can register online at www.sss.gov. Confirmation of registration will be sent to the student within two weeks. If the student does not have a Social Security number, the student should download the form here and submit it, along with all other documentation, to the MN Office of Higher Education. The paper Selective Service System Registration Form must be completed in black ink and in capital letters only. The document cannot be emailed or faxed to the MN Office of Higher Education; the original form must be mailed to:

MN Office of Higher Education

State Grant Unit

1450 Energy Park Drive, Suite 350

St. Paul, MN 55108.The Minnesota Office of Higher Education will make a copy of the form and mail the original to the Selective Service System on behalf of the student.

- Students will need to submit copies of signed student and parent (if dependent for financial aid) federal 1040 income tax returns for the prior-prior tax year (tax year 2018 for the 2020-2021 academic year). If the taxes were professionally prepared, a signature is not necessary. Schedules 1, 2, and 3, if filed: How do I know if I filed a Schedule 1? How do I know if I filed Schedule 2? How do I know if I filed Schedule 3? W2 forms are not required for tax filers unless there has been a change in marital status since the federal return was filed. If the student's and/or parents' income was so low they were not required to file a federal tax return, they should submit a signed statement indicating they were not required to file a federal tax return, along with any W2 statements. These documents will be required each year the student applies and will be used to verify the family income provided on the application.

- Applicants who have attended college for three or more years prior to the academic year for which they are applying must also submit a copy of a college transcript from each college they have attended. Student copies are acceptable if they are up-to-date.

- Eventually, documentation from federal immigration authorities verifying the student has applied for lawful immigrations status. The MN Dream Act states students will have to provide this document only if there is a federal process in place for them to apply for permanent legal status, which does not currently exist. So, documentation will not be required at this point.

With the exception of the paper Selective Service Registration Form, MN Dream Act Application materials should be email to MNDreamAct.OHE@state.mn.us or faxed to (651) 797-1637.

Do Deferred Action for Childhood Arrivals (DACA) students qualify for the MN Dream Act benefits?

DACA students will qualify for benefits if they meet the criteria for the MN Dream Act. DACA students who don't meet the MN Dream Act criteria may still be eligible for state financial aid if they can meet at least one of the criteria in the state residency law used for financial aid after they have been granted DACA. For example, one of the criteria in the state residency definition is graduating from a Minnesota high school while residing in Minnesota, so the student would need to prove DACA was granted prior to high school graduation. DACA students will be required to submit proof of DACA. DACA students who do NOT meet any of the MN Dream Act or state residency criteria will NOT be eligible for state financial aid.

How much will I receive from MN State Grant? Will it cover my tuition and fees at my college?

Probably not. The MN State Grant award will vary based upon the student's financial situation, enrollment level and the price of the college attended. It is meant to be a supplement to the Federal Pell Grant, which is the main federal need-based grant program. Even though undocumented students cannot receive a Federal Pell Grant, the amount of Federal Pell Grant for which the student would have qualified must be factored into the MN State Grant award calculation. This means the MN State Grant might be fairly low for students from low-income families who would qualify for Federal Pell Grants. The MN State Grant award notice you receive from the MN Office of Higher Education will display the amount of your MN State Grant for each credit level. Here are sample State Grant annual (two semesters or three quarters) awards [.pptx] at different types of colleges for a student from a very low-income family.

Will MN Dream Act or DACA students be eligible for any other type of state financial aid?

Eligible DACA students with work authorization and Social Security numbers can be considered for State Work Study funding, which allows the student to earn money working on campus. Eligible MN Dream Act students can also apply for a Postsecondary Child Care Grant, which is a need-based grant to students with children in child care while they attend school. These programs have limited funding and are administered by campus financial aid offices, so students should contact the financial aid office at the college they attend after completing the online state financial aid application to complete further paperwork for those programs. MN Dream Act students will also be eligible for tuition reciprocity benefits to attend a public college or university in North Dakota, South Dakota or Wisconsin. Any DACAmented or undocumented student can currently apply for a state SELF loan, which does not require the student borrower to have legal status, but does require a co-signer who is a U.S. citizen or eligible non-citizen.

Are there deadlines for applying for state financial aid?

To be eligible for a MN State Grant, the student must submit the online state financial aid application no later than the 30th day of the term. Deadlines for other state financial aid programs administered on campus are determined by the college the student is attending.

Does meeting MN Dream Act criteria or establishing MN residency after receiving DACA mean I am guaranteed state financial aid?

No. Financial aid programs have other requirements all applicants must meet, such as demonstrating financial need. It simply means these students are eligible to apply for and receive state financial aid on the same basis as documented students.

Will MN Dream Act or DACA students be eligible for federal financial aid?

No. The MN Dream Act is a state law that provides state benefits to Minnesota residents regardless of federal immigration status. Federal financial aid programs require students to be U.S. citizens or eligible non-citizens to apply for and receive federal financial aid.

Paying for College

This guide introduces you to the FAFSA and the Minnesota Dream Act.