Don’t let concerns about the potential cost of going to college be a barrier to earning your credential. There are a variety of resources available to help pay for education or training, including some that don’t need to be paid back.

Calculate Your Costs

Your costs will depend on what college or career school you choose to attend, what type of credential you choose to pursue, and how much assistance you receive through scholarships and financial aid.

As a start point, you should compare the institutions and programs you are considering by their published tuition and fees and net price. Published tuition and fees refer to the amount of tuition and required fees covering a full academic year most frequently charged to students at a particular institution. If tuition is charged on a per-credit-hour basis, the average full-time credit hour load for an entire academic year is used to estimate average tuition.

On the other hand, net price is the amount you must pay for your selected program after all grants and scholarships have been applied. It’s also referred to as the out of pocket cost. Be sure to check out “net price calculators” on college websites. Institutions are required to provide this information, and these calculators provide an estimate of what your college costs could be, taking into account grants and scholarships you may receive.

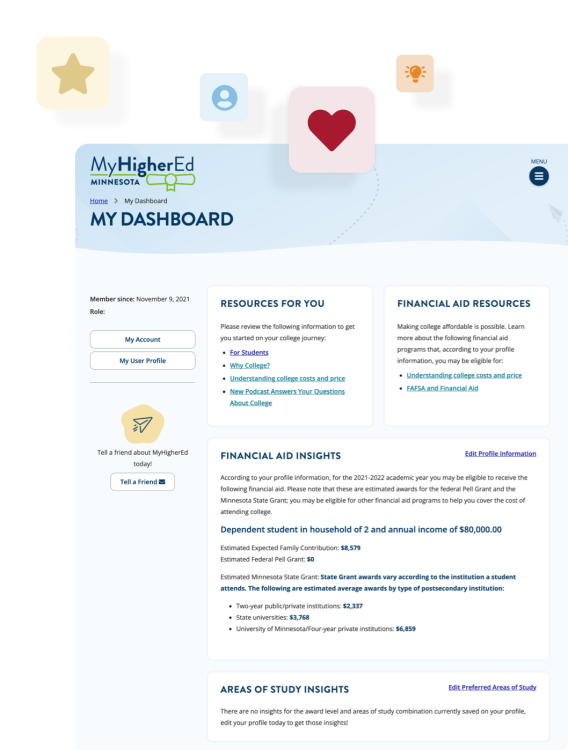

For your convenience, MyHigherEd also provides financial aid estimates and net price data to help you find programs that you consider affordable. By registering as a user, you can access customized financial aid estimates for the current academic year, according to information you provide on your profile. On your user dashboard you will view estimated awards for the federal Pell Grant and the Minnesota State Grant, according to the type of postsecondary institution you would like to attend. Please, note that you may be eligible to other financial aid programs to help you cover the cost of attending college.

Access Financial Aid Resources

Follow these steps to gain access to financial aid resources available to you:

- First, fill out the Free Application for Federal Student Aid (FAFSA). This is a must-do step for applying to any financial aid. If you are an undocumented student, please submit a MN Dream Act application.

- Second, learn about other types of financial aid available to you. This may include state and federal programs, scholarships, and grants, and a 529 saving plan.

- Third, get in touch with the financial aid office at the institutions you are considering to find out if they offer scholarships that you could apply for.

- Fourth, find out if you can count with support services at your institution. You should contact the colleges you are considering to request information about services for adult students like you, such as: childcare, housing and meals plans, emergency grants, online tutoring, food shelf, and counseling.

- Fifth, find out if you can rely on your employer to help you cover the cost of your program. Check with your supervisor or human resources representative to learn about tuition reimbursement or other benefits available to you.

You should also check out these programs and events tailored for workers and adult students:

- North Star Promise Scholarship (NSP): NSP offers tuition-free college for eligible Minnesota residents at eligible institutions by covering the balance of tuition and fees remaining after other financial aid has been applied.

- Workforce Innovation and Opportunity Act (WIOA): WIOA helps pay for training to give workers a chance to learn the skills and knowledge needed to compete in the new economy.

- Dislocated Worker Funds: If you were laid off (or notified that a layoff is coming) through no fault of your own, you might be eligible for career development, job search, and other services.

- Minnesota Postsecondary Child Care Grant Program: This program helps low-income students who have young children pay for child care while the student attends classes.

- Financial aid webinars: These online events provide free information and assistance to students and families about planning for college and applying for financial aid. These events are open to adult students.

College Search Tool

Search and compare programs and institutions by cost and net price.

Additional student financial aid is available to Minnesota students through work and loans.

- Check out these work study programs that provide part time on- or off-campus jobs to help students pay the cost of their higher education.

- Minnesota also operates a state loan program, the Student Educational Loan Fund (SELF Loan), for students and families who have exhausted or do not qualify for need-based aid.