Students have very real concerns about debt and employment opportunities. Higher education is a major investment – and may be one of the largest expenses you will face in your lifetime – so it’s important to understand what’s included in the cost of attendance.

Cost of Attendance

Education is one of the undeniable keys to success in Minnesota. Research shows that college graduates land jobs with better incomes, more benefits and, depending on the occupation, they’ll earn around $1 million more than those with only a high school diploma over the course of a lifetime.

Aside from improved earning potential, it can provide new life experiences, as well as a chance to advance your personal and professional goals.

All in all, higher education is an investment to your career advancement, future wages, and personal and professional development. That being said, the cost of this investment should be accounted for and balanced against your resources, financial aid, and your prospective earnings and employment opportunities in the field of your choice.

The cost of attending college is comprised of five main expenses: tuition and fees, room and board, books and supplies, transportation and personal expenses. Many of these expenses are discretionary, but accounting for them will help you create a college budget.

It’s recommended that you look beyond published prices or “sticker price” and instead consider the “net cost,” or the actual amount you and your family will pay after financial aid and institutional grants are applied.

What makes up the cost of attendance?

Tuition and fees

Tuition and fees are what students pay for classes and instruction provided by the college and automatic charges for services such as the health center, library or student activities.

The published tuition and fees are lower than what a college actually spends to provide a student’s education. Colleges, both private and public, often use funds provided by the state, donors, or campus services (e.g. bookstores, parking services, and housing) to cover costs of providing education such as paying for instructors, student services, administrative support, infrastructure, maintenance, and technology. These funds subsidize the cost of education for students.

Room and board

This refers to the basic price of living at the school during the academic year. "Room" refers to housing, whether it's in an on-campus dormitory or off-campus. "Board" refers to the price of eating, whether it's in the college cafeteria or buying food and preparing meals yourself.

Not all room and board options are available at all schools. Many two-year schools do not have on-campus housing. Some larger schools only have college housing for undergraduates or only for first- and second-year students. Some colleges do not allow students to live off campus until their third or fourth year.

As a rule of thumb, to lower your cost of attending college, you may decide to enroll at a local institution and keep living with your parents for either the entire time of your education or the first two years.

Books and supplies

Unlike in high school, students in college are expected to buy their own books. In addition, they're expected to purchase their own pencils, paper, art supplies, calculators and computer supplies. This includes whatever students need to complete their courses.

Personal expenses

Regardless of the type of institution you choose, plan for some personal expenses such as laundry, clothing, recreation, medical care, insurance and so on. Students should plan to spend at least $1,000 each academic year on these items.

Transportation

All students spend some money for travel, whether they live on campus or commute to school daily. Students living on or near campus must travel there at the start of the school year and return home at the end. Most students also go home at least once during the year.

Commuter students who travel to and from the school on a daily basis must carefully figure in the cost of fuel and parking or public transportation. Both can add up quickly. The transportation costs for commuter students are also built into the financial aid calculations used by the school.

Considerations

Paying for your college education can be daunting, but college financial aid can help make higher education possible for most students. An essential first step for all students who are interested in receiving financial assistance is to fill out the Free Application for Federal Student Aid (FAFSA). It is used to determine eligibility for institutional need-based grants, Federal Pell Grant awards, and Minnesota State Grant awards. Completing the FAFSA is also required for students and families interested in federal loans or work study.

- Most students are eligible for some type of financial aid. Minnesota students and families receive nearly $3.3 billion in financial aid or institutional discounts annually to help pay for college. The money comes from the State of Minnesota and the federal government, colleges, and private sources. There also are tax benefits and deductions that make what families have to pay more manageable.

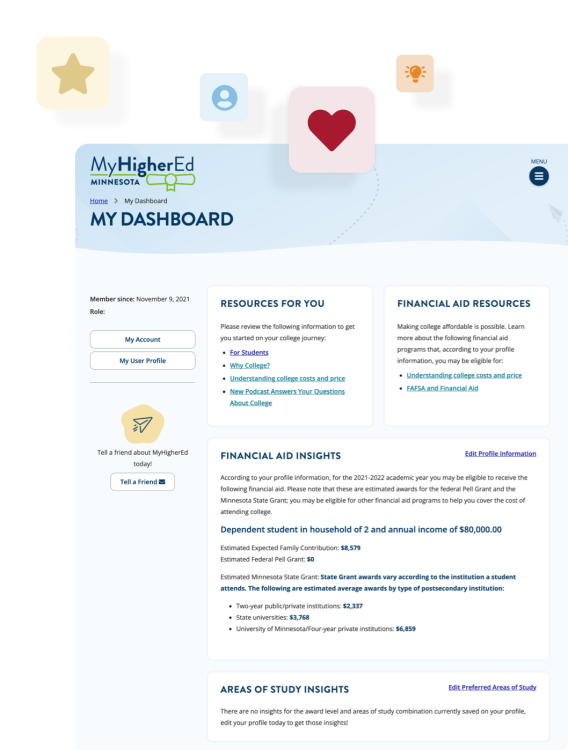

- Gain a more realistic idea of what the cost of attending a specific institution could be for you. We recommend using MyHigherEd's College Search Tool to look up and compare Minnesota institutions and the net price data by annual family income, if available. To this end, you should visit the website of each institution you are considering and use their net price calculator to estimate your cost of attendance. Net price calculators offer estimates on how much it might really cost to attend a particular college depending on family income after subtracting any federal, state and institutional aid undergraduate students may receive. You can also use our financial aid estimator for Minnesota colleges. Alternatively, consider creating an account to view the financial aid you may be eligible for according to the information provided on your profile.

Finally, you may search for net price calculators by college on the U.S. Department of Education's website or College Board's net price calculator to help gauge what it might cost you to attend a college of your choice anywhere in the nation.