Nowadays, finding a good-paying job requires education beyond high school. Having a college degree or other postsecondary credential or certificate remains a meaningful way for your child to achieve success. However, attaining a degree has never been more expensive.

It Is Never Too Early To Start Planning for College

Over the past several decades, the price students and families are asked to pay has steadily increased. Despite college affordability being a complicated and multi-faceted challenge, planning ahead can help you and your kid take practical steps to cut back on college costs.

If you are planning to support the education of your kid, keep in mind the following recommendations for an affordable postsecondary education. It is never too early to start saving or too late to consider these 11 sound strategies for making college affordable and possible for your kid.

Find a College You Can Afford

Compare Minnesota institutions by cost, financial aid, programs, and outcomes.

Eleven Eleven Ways To Make College More Affordable:

1. Open a 529 College Savings Account

Ideally, you should start saving for college as early as possible, but it is never too late to put money aside and figure out a college savings strategy. Whether your son or daughter is getting ready for pre-school or high school, you should figure out your options and consider opening a Minnesota College Savings Plan as another resource to pay for college later.

The Minnesota College Savings Plan, MN Saves, was created and is managed by the State of Minnesota. This tax-advantaged 529 college savings plan is meant to help families and individuals plan for the cost of education. It’s available to any citizen or tax payer. The Plan offers an easy way to make contributions to the college savings account and a variety of professionally managed investment options to choose from, and as a 529 Plan, it also offers unsurpassed federal and state tax benefits. To learn more about MN Saves and open an account, please visit their website and their FAQ page.

2. Apply for Financial Aid

Given the exponentially increasing cost of college, if may feel out of reach for your child. However, financial aid has helped millions of students pay for their education beyond high school.

Keep in mind that while a financial aid package often includes student loan options, it can also include work study, which is money that your student earns while pursuing his or her education. Financial aid may also include grants and scholarships, which don't need to be paid back.

This funding is made available through the federal and state government. A new Minnesota program that could benefit your kid is the North Star Promise Scholarship, which offers tuition-free college for eligible Minnesota residents at eligible institutions. Many colleges and universities also offer their own assistance to students through institutional grants and scholarships. These are often based on past academic performance, or financial need.

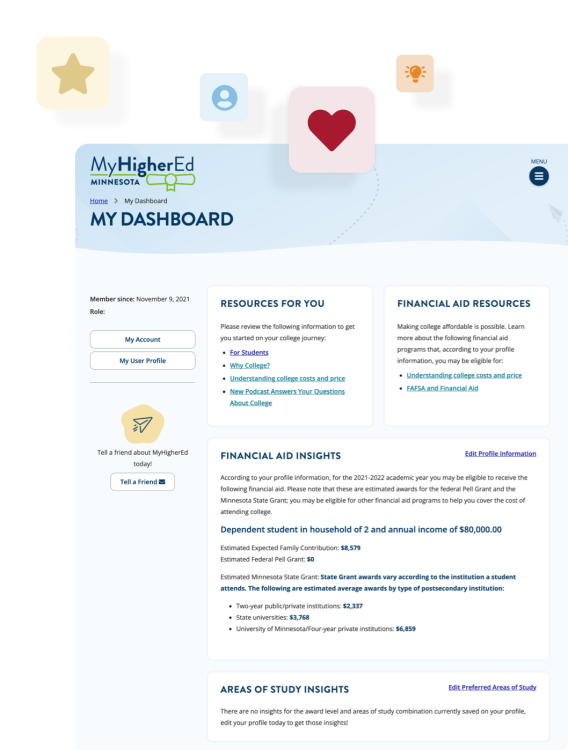

Financial aid eligibility begins by filling out the Free Application for Federal Student AID (FAFSA). After your kid applies to one or more colleges, the FAFSA is the starting point for receiving financial aid no matter where he or she ultimately decides to enroll.

3. Negotiate Financial Aid Awards

If your child has been accepted to their dream school, but the financial aid package it is offering isn’t as robust as you had hoped for, it can be negotiated. In fact, there’s very little downside in asking since negotiations are successful about half of the time.

However, aid packages are determined using objective criteria, so it’s best to not treat it like negotiating for a vehicle. Instead, determine exactly what is needed to make attending that college a financially feasible option for your family, and have evidence to back it up. It is also helpful to submit the request and information in writing to the school’s financial aid office.

Notably, negotiations are different from an appeal, which is a formal process you would take if your financial situation has changed since you filled out the Free Application for Federal Student Aid (FAFSA). Experiencing a job loss or illness would be grounds for an appeal.

4. Keep an eye out for scholarships

Scholarships are one of two forms of financial aid that do not need to be repaid. They are awarded based on a student's academic or athletic achievement, cultural or religious background, or special skills and talents.

Scholarships may be awarded through an institution as part of the financial aid package without additional paperwork, or your student may also need to search and apply for specific scholarships.

There are also many private scholarships given by community organizations, foundations, corporations, clubs, civic, and cultural groups.

If your student is looking for private sources of financial aid, her or she should:

- Check with your employer, professional association, or labor union.

Inquire at community organizations such as the Chamber of Commerce, churches, or Rotary Clubs. - Check with his or her high school counselor.

Scholarships can also be found online using one of the free scholarship search sites listed below:

However, before your student accepts any scholarships review these scholarship tips. In addition, be wary of any scholarship search companies charging fees, guarantying scholarships, and asking for your credit card or checking account information to receive a scholarship.

5. Earn credits while in high school

One of the most effective ways to lower postsecondary school costs is for your child to earn college credits while in high school. Most of these programs are free, but not all programs are available in all schools. Participation may also require a certain academic standing.

Advanced Placement (AP) is offered at many schools. These are college-level courses in English, history, humanities, languages, math, psychology, and science and more. Classes are taught at your high school. You can earn college credit if you score high enough on a fee-based exam. It is free for low-income students in Minnesota.

Concurrent Enrollment (CE) is often referred to as “College in the Schools (CIS)”. CE offers college-level courses at your high school through partnerships between high schools and local colleges and universities. These courses are free to the student. Students earn both high school and college credit by successfully completing the course. Taught by qualified high school teachers, faculty, or team-taught by both.

International Baccalaureate (IB) is a two-year pre-college diploma program offered at some high schools. You must pass a fee-based exam in each of six subject areas (your primary language, a second language, mathematics, experimental sciences, the arts and humanities) in order to potentially earn college credit.

Postsecondary Enrollment Options (PSEO) allows students in grades 10 through 12 to take college courses at a Minnesota college, university, or online. Students attend class and complete the same assignments required of regular college students. State funds cover the cost of tuition, books and lab fees. Students earn both high school and college credit for successfully completing courses.

Project Lead the Way (PLTW) is a provider of hand-on science, technology, engineering, and math (STEM) programs using an interdisciplinary framework. This experience requires students to take a fee-based exam. Not all colleges accept credit from PLTW.

College-Level Examination Program (CLEP) offers students a chance to earn college credits based on what they already know. CLEP exam-takers include adults just entering or returning to school, military service members, current high school students, and traditional college students. CLEP exams are fee-based in various subject.

6. Aim to graduate within the shortest time possible

On a related note, earning college credits while in high school can be a good strategy to get a head start. Not only does it potentially reduce overall tuition and room and board expenses, but early planning can also help your kid graduate within two or four years, depending on the program of their choice. This allows them to start their careers sooner or continue onto advanced degrees.

Even if they didn't earn credits while in high school, planning ahead their credit load per term -making sure their chosen courses will count towards their degree attainment- will help them set annual goals and stick to a plan for timely completion. Completing a degree as soon as possible may seem irrelevant, but students who take longer to graduate typically end up paying more in tuition, placing them at risk of not being able to finish due to lack of funds.

Taking extra years to complete your degree carries the loss of potential earnings in the labor market. However, being unable to graduate at all, leaves a student with the heavy load of student debt and no degree to access higher earnings in the near future.

7. Go to an in-state college or utilize tuition reciprocity agreements

The terms in-state or out-of-state tuition apply only to public colleges and universities. In-state tuition is typically much cheaper than out-of-state tuition. The reason out-of-state tuition is more expensive is because non-resident students come from families who haven’t paid tax dollars to that state, and by proxy, the school.

Given that, if your child is interested in attending a public school, choosing an institution in-state is one way to keep college more affordable.

Another affordable option is for your child is to utilize the state’s regional tuition exchange program. Minnesota has statewide tuition reciprocity agreements that allows students to attend institutions in Wisconsin, North Dakota, South Dakota, and Manitoba at reduced tuition rates.

Students must apply for tuition reciprocity benefits and should do so as soon as they know they know they’ll be attending an eligible institution. Applying early ensures he or she will be charged the reciprocity tuition rate when they register for classes.

8. Go to community college, then transfer

For some students, a community college program, certificate or associate’s degree is exactly what they need in order to take the next step in their career. For others, attending community college before transferring to a four-year university is a great option to keep costs more affordable, as they figure out their career path while completing their general education requirements. Aside from typically having lower tuition costs, some students choose to attend college near their hometown it allows them to save a lot of money by living at home and commuting.

9. Community service or military benefits

Some students pay for part of their college education by serving their community or country before or after they attend college. Students can gain valuable experiences through diverse programs that reward work and service with financial aid for college.

AmeriCorps

AmeriCorps is a cooperative effort between the federal government, the state, and local agencies to improve community service around the country.

Jobs often are available in projects addressing preschool education, dropout prevention, literacy, low-income housing, assisted living for the elderly and people with disabilities, violence prevention, conservation, and neighborhood recycling. You may be eligible to receive a stipend and an education award through the program to help pay for your education.

Military Service

Those called to active duty while enrolled in college receive certain protections regarding financial aid eligibility, enrollment status, and loan repayment. In most instances, a student will not be penalized as a result of his or her absence to perform active military service.

In addition, there are federal and state educational benefits for students who have served or are serving in the armed forces.

10. Rent textbooks or buy digital versions

One of the ancillary costs of attending college is paying for textbooks and other class materials. Depending on the course, these expenses can add up quickly. Some options to control these costs are to rent textbooks or buy digital versions.

Additionally, more and more colleges, including Minnesota State colleges and universities, are facilitating the adoption of open, low-cost, high-quality materials, called Open Educational Resources. These OERs are teaching, learning and research resources that make use of open licensing. Minnesota State has also developed ‘zero-textbook cost’ associate degrees at six colleges.

11. Professions that offer loan forgiveness

Pursuing certain jobs and professions in Minnesota could offer your student some loan repayment assistance. Examples include:

- Minnesota Agricultural Education Loan Repayment Program

- Minnesota Rural Veterinarian Loan Repayment Program

Additionally, the federal government offers the following loan repayment and forgiveness programs that Minnesota students may be eligible for: